In previous posts I’ve talked about the differences between investing in TD e-Series funds through a TD Mutual Fund account and a TD Direct Investment account. Both are good options, and many start with the simpler path of investing through a TD Mutual Fund account. Eventually, this may not meet your needs anymore, and you’ll need to move from investing through TD Mutual Funds to TD Direct Investment.

Recap: TD Mutual Fund Account vs TD Direct Investment Account

To make sure we are all on the same page, let’s quickly go over the 2 ways you can invest in TD e-Series funds.

TD Mutual Fund Account

The TD Mutual Fund account allows you to buy TD e-Series funds your regular online banking portal (TD EasyWeb). But first, you will need to setup a mutual fund account that has been converted to an e-Series account for this option to be available online. Using a TD Mutual Fund account is typically the cheapest and simplest way to invest in TD e-Series Index Funds.

Fees: There are no fee’s for buying and selling TD e-Series funds through this account, nor are there any fees for the account itself. You can make as many mutual fund trades as you like for no commission, which makes this a good option for those who want to contribute monthly to their portfolio.

TD Direct Investing Account

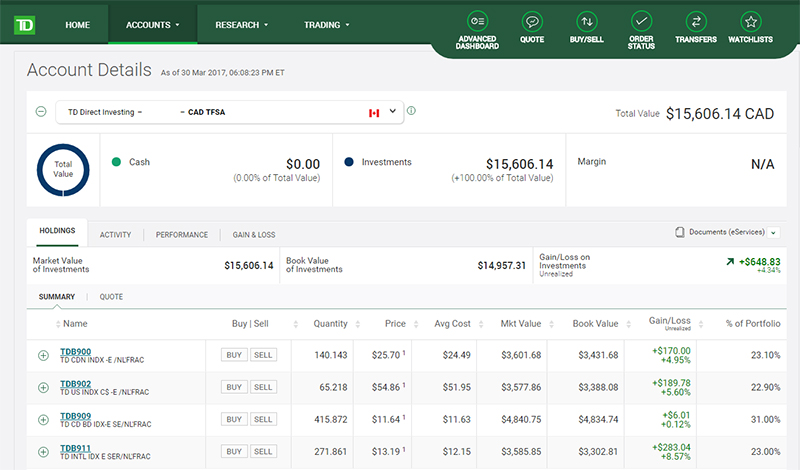

You can also purchase e-Series funds through a TD Direct Investing account. It is TD’s online investment brokerage that you can use to trade in markets across North America, and buy stocks, options, ETF’s and mutual funds, including the TD e-Series Index Funds. TD Direct Investing is a more robust system that provides more information, and allows you to do more than purchase and sell mutual funds.

Fees: There are no trade commission fees when buying TD e-Series index funds through TD Direct Investing. However, there is a quarterly maintenance fee of $25 ($100 per year). You can have these fees waived by investing more than $15,000 or by setting up an automatic monthly investment deposit of at least $100.

Why I decided to switch

Up until recently, I had all of my TFSA and RRSP investments in TD e-Series funds through my TD Mutual Fund accounts. I did all of my day-to-day banking through TD and I liked that it was simple, free, and easy to make regular and irregular additions to my investments

That changed through when I switched my day-today banking needs from TD to Tangerine. While you can setup an authorized pre-payment plan to make contributions to your TD Mutual Fund account from a bank account outside of TD, there isn’t an easy way to make contributions on your own schedule or of varying amounts. They have to be the same amount every time and at the same time of the month. Since I like to make additional contributions whenever I have some extra money lying around, this wasn’t going to work for me.

I still liked the TD e-Series funds as a better investment option than the ones that Tangerine offered, and I didn’t want to switch. The answer – a TD Direct Investment Account.

You are able to contribute to your TFSA and RRSP in your TD Direct Investment account by making a bill payment from another institution. This means that whenever I want to add money to my investments, I just make a bill payment to my TD Waterhouse payee, and a few days later, the money shows up and I can buy additional shares. Easy and flexible.

So I switched my investment method from TD Mutual Fund accounts to TD Direct Investment accounts to stay invested in my TD e-Series funds.

How to move from TD Mutual Funds to TD Direct Investment

To make the switch, you’ll need to physically go to the bank.

1. Call ahead and make an appointment

You never know how busy the bank will be. I suggest calling ahead and making an appointment instead of just dropping by. Mention that you want to open a TD Direct Investment account.

2. Bring a void cheque

Bring a cheque from the bank you want to withdraw investment funds to. While you really shouldn’t be thinking of cashing in investments, it’s good to know that you can. The rep will be able to use this as your default withdrawal account – when you cash in funds from your TD Direct Investment account, this is where it will go. Yes, it can be a different bank than TD.

3. Ask to open a TFSA and/or RRSP account

Tell the TD Direct Investment rep that you want to open up a TFSA and/or RRSP account with TD Direct Investing and that you want to transfer the funds from your current TD Mutual Fund accounts to the new TD Direct Investment Account. Tell them you want the funds to transfer directly, you want the same funds you currently have, but in your new TD Direct Investment account.

4. Don’t be bullied or swayed

The rep may have questions about your investment decisions or try to sway you to a different investment – don’t let yourself be bullied! You can answer honestly: you like the low fee’s and the personal management of the TD e-Series funds. They shouldn’t push too hard.

5. Sign papers

You’ll have to sign the papers they provide you, these will be the papers that they mail off to open your new TD Direct Investment account. I know it’s hard, but I suggest at least skimming them, if not fully reading them.

6. Wait a week or 2 for your new account

As with other things to do with TD e-Series, it takes a week or 2 for your new TD Direct Investment accounts to open. You should receive an email when the new account it open and ready. Your money WILL NOT have been transferred yet, so don’t fret if you see 0’s!

7. Sign the transfer payments paperwork

Once the TD Direct Investment accounts have been opened, you’ll have to go back to TD in person to sign the paper work to authorize the switch in funds from your TD Mutual Fund account to your TD DI account. Your TD rep will send this in by mail, which will take another week or 2 for your funds to actually transfer.

- NOTE: Your current investments will remain invested until the switch happens, you won’t lose any investment income during this process.

8. Confirm your transfer

Once this transfer goes through, you should again receive an email from TD confirming your purchases in your new TD Direct Investment account.

- NOTE: I switched both my TFSA and RRSP at the same time, but the fund transfers went through on different schedules. Don’t fret if one transfers before the other ones does if you do both.

There you have it

You should now have your TD e-Series investments up and running in your TD DI account. You can now take advantage of the beefed up interface, add to your investments through bill payments, and have a wider array of investment options available to you.

Thank you for your post. I’m currently looking into doing this with our RESP’s. Were there any fees for transferring out your TD mutual funds? I know there are fees when you transfer between institutions but does this count as that kind of a switch?

There are no fees when transferring from TD Mutual Funds to TD Direct Investment, although there is some paperwork that needs to be done through the bank.

I am currently investing with a financial planner with TD. I want to start investing on my own so I opened a TD Direct Investing Account to start investing in the E-Series Funds. I got the TD branch person to transfer my RRSP/TFSA mutual funds to my Direct Investing (she did a in kind transfer). My question is once they are switched over, I want to switch the funds they are currently in and put into the e-series funds. Can I simply to transfer mutual funds or do I sell and have to re-buy the new funds

Much like if you were going to re-balance your portfolio by using the “switch” option, you should be able to “switch” between whatever funds you have now, and move them into e-Series funds, without having to sell them. This should keep everything neat and tidy, and keep all of your funds within your respective TFSA and RRSP accounts.

Thanks so much for posting this. I’m near the 15k mark on my TSFA and have been looking to switch. This post makes the whole process much less daunting.

Glad I can help!

I already have a TD Direct Investing Account -CAD Cash. Also, I had mutual fund RRSP and TFSA both in TD Comfort balanced Portfolio. I decided to start investing in the E-Series Funds. I got the TD person to transfer my RRSP/TFSA mutual funds to my Direct Investing A/C. Now I have Cad Cash in TDB8150 (saving with 1.1%), SDRSP in cash ( the bank person made the fund ready for e-fund) and CAD TFSA in the same fund as before- TD Com Bal Incm (for future transfer). Now I want to invest in E-series fund.

Please advise how to invest in e-fund from my a/c. I think that from my TFSA and CAD cash I can make the transfer. My SDRSP is already in cash and should I simply buy the E-Series Fund?

Another question. When the bank person transferred my RRSP from the mutual fund in TD Direct Investing Account SDRSP in cash do you think it will be some tax penalty?

Hi Luba,

You’ve got a lot of information in your post here, so I’ll see if I understand correctly. Your funds are currently as follows in your TD Direct Investing account:

CAD Cash – TD Investment Savings Account (TDB8150)

SDRSP – Cash holdings

TFSA – TD Comfort Balanced Portfolio

If I’ve got this right, then in your SDRSP, you can just buy the new TD e-Series funds with your cash, as per this article: https://letstalkaboutmoney.ca/step-step-buy-td-e-series-index-funds-td-direct-investment/

In your TFSA, you can use the “Switch” option to switch from the TD Comfort Balanced Portfolio, into different TD e-Series funds. When you click on your TFSA and can see the different funds that you have, you can click the ‘sell’ button. Once you do that, a new window pops up, and provides you with an ‘Action’ option which will currently be on ‘Sell’. Change that to ‘Switch’, which will then allow you to define which fund you want to switch your funds into.

As for your second question, if the bank representative transferred the funds from your previous RRSP account, into your new SDRSP account, then there should be no tax implications, as you didn’t sell or withdraw any funds from an RRSP account, you just moved them.

Hope that all helps. Let me know if you’ve got any follow up questions.

Thanks a lot!!! It is very helpful! Now I understand how this works, Regards.

There seems to be a lot of information about transferring RRSP and TFSA, but what about Non-Registered Accounts? I currently have a cash account through TD Managed Funds and a separate Cash account with TD Direct Investing. I want to know how/if, I can transfer that Managed “Cash” Account to Direct Investing?

It’s hard for me to speak to this, as I’ve never gone through the process of transferring managed funds to a TD Direct Investing account. Do you hold the managed funds in a regular TD Mutual Fund account?

As my experience mostly revolves around registered TFSA and RRSP accounts, I wouldn’t feel comfortable commenting on how to move between non-registered accounts, as I don’t know the full tax implications of moving investments. I would recommend talking to a TD representative to ask how to move from your Managed Funds to your TD Direct Investing account, and the associated taxation that might come with that. Once you have the money in your Cash account in TD Direct Investing, it should be the same process to buy the different TD e-Series funds, just using a non-registered account instead of a RRSP or TFSA.

Sorry I can’t be more help on this topic.

How do I contribute monthly to my TFSA and/or SDRSP accounts within Web broker from my TD Chequing account? Once its in, do I have to manually allocate the funds each time I deposit or is there a way to automatically allocate to each fund (i.e. lets say $100 each month and I want to follow the assertive TD e Series CCP portfolio, so $25 to each of the 4 index funds)?

Hi David,

I don’t have any direct experience with automatic payments from a TD chequing account into TD Direct Investing to buy specific funds, so I won’t be able to give you a definitive answer. From what I’ve seen, the option is available to automatically transfer money from TD chequing to a TD Direct Investing account, but from there, you would have to manually purchase each of the funds in your portfolio.

I would take a look over the forms on this page:

https://www.td.com/ca/en/investing/direct-investing/why-us/getting-started/forms/

specifically the Pre-Authorized Deposit (PAD) Form / Monthly Contribution Plan (MCP) Form. No matter what, to set up an automatic transfer plan, you’ll have to fill out one of these forms and provide them to a TD Direct Investing rep – at that point you could check with them to see if it’s possible to setup an automatic asset buy right after the transfer.

Sorry I can’t be more help, but feel free to post back if you find out more information about this.

I have an unregistered e-series Mutual Fund account with >$15k invested. I don’t contribute monthly but haven’t had any issues doing so with lump sums from a non-TD checking account (e-interac to TD, move to Mutual Fund account, buy e-series funds). You seem to suggest above that this would be the main reason to prefer TD Direct Investing over Mutual Fund account, are there other reasons?

I do want to move my RRSP and TFSA from another bank to TD – would I need TD Direct Investing to achieve this or can I still use Mutual Funds?

I’m new to Canada so some of the terminology is confusing and I don’t want to miss something important between the two options.

If using TD Mutual Fund accounts is working for you, then there aren’t any major advantages to using TD Direct Investing instead. I prefer the TD Direct Investing platform and user interface, but that is just purely preference.

If you can get TD to do a registered transfer of funds from your current RRSP and TFSA holdings to your TD registered Mutual Fund accounts (you’ll probably need to fill out some paperwork to do so), then sticking with TD Mutual Funds should be just fine.

Thank you. I have found my local TD branch advisor to be extremely helpful to date so I’m confident I get the paperwork done. Having figured out how to use easyweb I’m happy to stick with it if there’s no advantage to switching. Your input is appreciated!

I had to write to thank you for the information on how to switch from TD Easyweb to TD Direct Investments (TDI). I have agonized over this for some time and your blog has helped to allay for inertia to getting it done. I have three of questions: 1) Can I open a non-registered account the same way as the RRSP and TFSA? 2) Can I only contribute to my TD E-series by making a bill payment from another institution or can I continue to pay into my savings account as I now do with Easyweb? 3) Once the money is in the account, are there any charges by TDI to buy any of the E-series funds?

Thanks for the feedback Ben, and sorry about the delayed response. I’ll try to answer your questions the best that I can:

Yes you can. When I opened up my accounts, they automatically opened a Cash account as well, which would act as a non-registered investment account.

I think I may need a bit more info here. Do you currently have a chequing and/or savings account with TD that you are planning on keeping? If so, I can’t remember exactly as I don’t have a chequing account with TD anymore, but I believe there is an easy way to transfer funds directly from your TD chequing account into your TD Direct Investing account, instead of doing it as a bill payment.

Nope, no additional charges (not counting the built in MER’s).

Hope that helps!

Thanks for the reply, it was most helpful. In response to your question, no I do not have a chequing account with TD due to their ludicrous fees. I do however have an Everyday Savings account. I may therefore need to use bill payment to transfer funds in the future.

Following your recommendations, I went to my local TD branch and submitted the required paperwork to open up the afore mentioned accounts. It took a while but the process went quite smoothly since I was prepared. I had one problem though, I could not set up a “default withdrawal account” as you mentioned in your article. I tried to give the TD Advisor a void cheque, from my other banking institution, but he told me that TD Direct Investment arm could not be linked to an external bank. Can you explain in a little more detail how your “default withdrawal account” was set up?

Interesting. I know that when I signed up, I filled out a form provided by my TD Advisor that designated a default withdrawal account, but that’s not to say that their process hasn’t changed since I signed up. I’ve never actually withdrawn any money from my DI account, so this isn’t something I can directly speak to at this point. Did the Advisor give you any other options for how you would withdraw your money when the time came?

Sorry for the late reply as I missed that you had responded. Yes the Advisor said that money could be moved to my TD Every Day Savings Account. This is the arrangement I currently have with the mutual e-series set up. One of the impetuses to setting up the TDDI account was the opportunity to link this account with my external bank.

After the meeting, I subsequently advised him of the fact that your article stated that it could be done. His email response was to bring the article on my next visit and he would follow-up with TDDI.

Thank you for all the great information!

I am just starting to learn about couch potato investing. I’m a bit nervous as my knowledge in investing isn’t great yet but I know enough that my present mutual funds are costing too much.

I am planning to start with the e series balanced portfolio. I have about 50k in a high interest tfsa and about 20k in rrsp that I want to transfer.

Should I start with a mutual fund account or go directly to the direct investing account to purchase the e series? All my banking is with TD. I plan to do monthly or quarterly contributions.

Also, the current tfsa and rrsp are split between my husband and I. Would we set up our own TD investing accounts? Or is there some kind of joint/household account?

Thank so much!

If you already do your day to day banking with TD, then it would probably be easiest to start with a Mutual Fund account. If you are sticking with only investing in TD e-Series funds, than the Mutual Fund account should provide you with everything you need, and easy options to purchase and sell e-Series funds at no cost.

Unfortunately I can’t speak to joint/household accounts, as I currently have my accounts setup as an individual, and have never invested in a joint account. Something like that would be best to talk directly to a TD Advisor about anyways, as there can be some nuance to what would be best for your own situation.

Thank you for the quick response!

I am also looking at Wealthsimple and Questwealth (balanced portfolio). Besides fees, how do they compare to each other and to the e-series as far as performance and the type of ETF’s that they are holding?

You’ve asked some good questions here that could fill a few new articles with information. The best I can give you right now is a few links from their own sites on returns:

Wealthsimple

https://help.wealthsimple.com/hc/en-ca/articles/214187018-How-has-the-Growth-portfolio-performed-

https://help.wealthsimple.com/hc/en-ca/articles/214187188-How-has-the-Balanced-portfolio-performed-

https://help.wealthsimple.com/hc/en-ca/articles/214880087-How-has-the-Conservative-portfolio-performed-

Questwealth

https://www.questrade.com/questwealth-portfolios/etf-portfolios

TD e-Series

http://www.tdcanadatrust.com/products-services/investing/mutual-funds/price_performance.jsp

As far as exactly what is contained in these ETF’s, I would suggest doing some reading into the Fact sheets and info pages. The links above for Questwealth and Wealthsimple have sections that explain a bit more on what the specific holdings are. Here are the fact sheets for TD e-Series funds:

TD e-Series Fact Sheets

https://www.tdassetmanagement.com/Fund-Document/pdf/Fund-Facts/TD-Mutual-Funds/TDB900E.pdf

https://www.tdassetmanagement.com/Fund-Document/pdf/Fund-Facts/TD-Mutual-Funds/TDB902E.pdf

https://www.tdassetmanagement.com/Fund-Document/pdf/Fund-Facts/TD-Mutual-Funds/TDB909E.pdf

https://www.tdassetmanagement.com/Fund-Document/pdf/Fund-Facts/TD-Mutual-Funds/TDB911E.pdf

Thank you for putting together all these references! This is great info! Much appreciated

I am currently moving my TD mutual fund RRSP and TFSA accounts to TD Direct Investing accounts. I was wondering if I should sell my mutual fund in cash first before I transfer? Some people suggest that I should move all in kind so I can sell it on my own. But I thought I could redeem it on my own for free on easyweb and move in cash so I can save the $9.95 to sell it after I move it into my Direct Investing account? Not sure what is the better way to do it and also if I want to move my investment to Questrade eventually, would it be better to move it from mutual fund account or from Direct Investing account? What’s the difference? Thanks in advance.

I would be careful if you sell the funds first, as if you sell the funds and that moves the cash into your regular banking account, it will count as a withdraw from those registered accounts, and you will face tax implications for your RRSP, and lose the TFSA room for the rest of the year. The best bet would probably be registered transfer in kind (a TD rep can help you do this). TD e-Series funds shouldn’t have any trading fees.

Transfering money to a different institution (such as another Bank or Questrade) can be a little difficult from a TD Direct Investing account. When I recently sold some of my funds, I had to move them to a TD easyweb savings account before I could transfer them to another bank. So if you are planning to move funds to Questrade, it’s probably easier to keep them in your TD easy web banking accounts.