I’ve written a guide on the differences between investing in TD e-Series funds through a TD Mutual Fund Account and a TD Direct Investment Account. I’ve also written how to buy and rebalance your e-Series funds through the TD Mutual Fund Account. Now let’s look at how to buy TD e-Series Index Funds through TD Direct Investment accounts.

Before you start

Before you can start trading using TD Direct Investment, you’ll need to setup some accounts. This can be done online or in person by setting up a meeting with a TD Direct Investment rep from your local bank. If you already have a portfolio within a TD Mutual Fund account, see my guide on switching from TD Mutual Fund to TD Direct Investment.

I suggest opening a Tax-Free Savings account and/or a Self-Directed RSP account for your investments, which are both available in the TD online application.

Logging in

To access the TD Direct Investment portal, you login to your TD EasyWeb account with your access card code, the same as you would for any of your day-to-day banking.

Find your investments

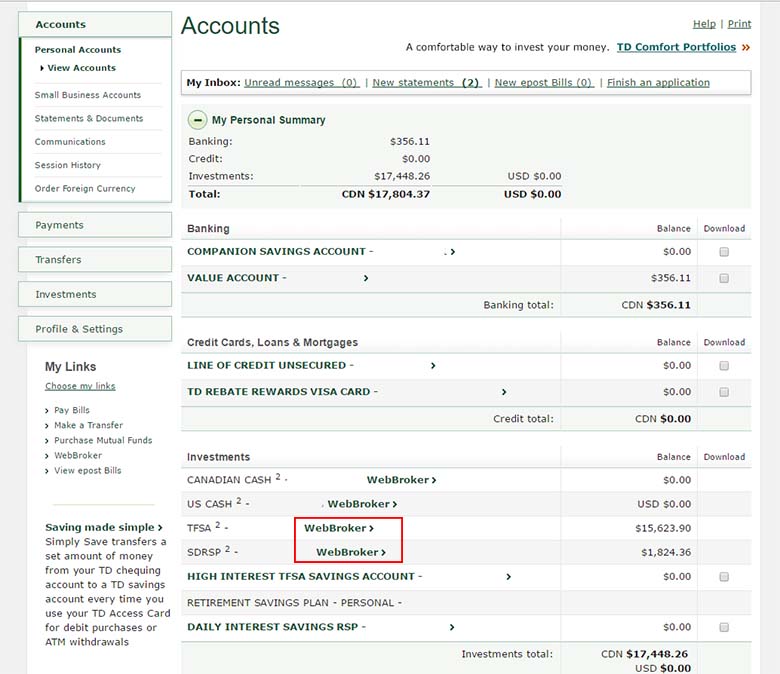

Once logged in, on your main overview page, scroll to your investments section, and click on any of the “WebBroker links. This will take you to the TD Direct Investment portal.

Find your right account

Now click on the account that you want to make TD e-Series purchases in. NOTE: You’ll need to have cash funds in that account to make any purchases.

Purchase your TD e-Series funds

Select the “Buy/Sell” icon at the top of the page

![]()

Select the “Mutual Funds” tab of the buy window. You’ll need to make sure you have funds available to trade (shown as Cash in the top right corner of the buy window. You’ll also need to fill in the following fields:

Action

Like in a TD Mutual Fund Account, you can Buy, Sell or Switch. If you are buying funds, select the “Buy” option.

Symbol Name

Search and select the symbol name for the TD e-Series fund that you want to purchase. They should show up as you start to type them in. If you are using the Canadian Couch Potato strategy for your e-Series funds, here are the Symbols:

- TDB900 – TD Canadian Index Fund-e

- TDB902 – TD U.S. Index Fund-e

- TDB909 – TD Canadian Bond Index Fund-e

- TDB911 – TD International Index Fund-e

Quantity type

Allows you to choose to buy in dollars, or in amount of units. I always choose dollars to make sure I know exactly how much I’m buying.

Dividend option

You can select to either have your dividends re-invested, or payed out in cash into the same account. I recommend re-investing the dividends – you can always cash them out later.

Amount (including commission)

You’ll need to check this box. Don’t let the word commission scare you – there are no commissions when purchasing TD e-Series funds.

Trading password

You’ll need to fill in a Trading password (this option can be turned off in your settings). If you didn’t receive one when you opened the accounts (I didn’t), you’ll have to call into the TD Direct Investment phone line and get them to assign you a temporary one.

Select the “Preview Order” button on the bottom right to continue.

Previewing order

Make sure to confirm all of your details in this window. The preview screen also shows that you will be charged $0 for your commission, and provides some additional warnings about minimum holding periods, and long term fees charged by TD Direct Investing – the usual fee’s associated with holding the investment. Select the “Agree & Send Order” button to finalize your purchase.

Buy confirmation

You will now be given a confirmation page that your order was received, with the details and a reference number. Your purchase is now complete.

You’re order will be placed at the end of the current trading day, or at the end of the next trading day if the markets are already closed.

Start your TD e-Series portfolio

You can now repeat that process for all of the funds you want to include in your TD e-Series portfolio. A pretty simple process, but it’s always nice to have it laid out step by step with pictures. Was this article helpful? Let me know in the comments below!

Okay, this might be a dumb question but I’m a beginner.

So when people talk about the % in each mutual fund (like the CCP where it’s 25% in each of the four mutual funds for the aggressive portfolio) does that mean 25% of your cash in each or 25% of the stock amount?

Like if you have $100, does it just go $25 in each fund regardless of price?

Yep, you’ve got it. 25% of your portfolio worth (it’s cash value) should be in each asset. So if you are starting a new portfolio, and have $100, you would buy $25 of each. That way the cash value of each of your assets is 25% of your portfolio. It doesn’t matter what the price of the assets are, as long as the worth of your investment in that asset is 25% of your portfolio.

Hope that makes sense.

Hi there.

Super dumb questions:

1) can I use the TD app to do this?

2) I think there are annual costs associated with having a TD direct investing account… if I go with the e-series instead of buying stocks, can I get out of those banking fees?

No dumb questions here.

1) There is an app that you can access your funds with, and I’m pretty sure you can make trades with as well. The problem is the app only works if you have an associated TD chequing/savings account. For me, I only have a TD Direct Investment account, no chequing/savings, so the app won’t let me log in. I used to be able to use the app when I did all of my banking with TD.

2) There is an annual cost to use TD Direct Investment, but only if your total portfolio is under $15,000. If your portfolio is under $15,000, I suggest using a TD Mutual Fund account to invest in TD e-Series, because a TD MF account is free no matter how much you are investing.

That is not correct. The app works even if you only have investment accounts, you do not need a TD bank account.

You are correct! Since this comment was posted, TD released a major overhaul of their app, which now includes a pretty comprehensive section on investments.

Hi,

Can I set up a monthly ppp that will buy the same percentage of funds? For example if I buy funds similar to the Canadian Couch Potato portfolio, 40% bonds, 20% can equity, 20% us equity, 20% intl equity, can I set up automatic monthly purchases at the same amounts or %’s every month?

If so, how is this done?

Thank you.

There is a way to set pre-authorized deposits to deposit cash from a chequing account that you have, into a TD Direct Investment account as Cash (using a form found here: https://www.td.com/ca/products-services/investing/td-direct-investing/accounts/forms-applications/index-res.jsp), but in my research, I’ve haven’t found a way to setup pre-authorized purchases of certain funds once that cash is in your TD Direct Investment account. Unfortunately you may have to talk to a bank representative to find out if there is a way to set it up outside of the website.

It would be possible to do if you were investing through a regular TD EasyWeb Mutual Fund account, with the Pre-Authorized Purchase Plans option.

To do it based on percentages would be fairly easy, by just dividing the total amount that you want to buy each month by your percentages, and setup pre-authorized purchases for each of those amounts. For example, if you were setting aside $1000 a month to be invested in your portfolio, based on your example percentages, you would setup a pre-authorized purchase plan for $400 bonds, $200 us equity, $200 canadian equity, and $200 intl equity. You would still need to revisit your portfolio maybe once a year to do a total rebalancing of your whole portfolio.

Brian would save money by putting it into the TD

Managed Index Balanced Growth Portfolio-e

It has a 1.27% MER (as opposed to the 1.68 total MER of the plan he outlined), a $2000 minimum initial investment, and is mixed as follows:

40% Canadian Universe Bond Index

40% MSCI World Index Net Dividend C$

20% TSX Composite Total Return Index

However, I believe he’d do even better with the Tangerine Balanced Growth Portfolio at 1.07%.

You don’t add up the MERs. If anything you would do a weighted average MER.

I don’t really know why but my direct investing accounts (TFSA and a non registered account) both have two accounts each, one Canadian and one US. Do you know why this is? Are US bonds/stocks meant to be invested under the US account? I’d like to follow the Canadian couch potato portfolio, and based on your blog, it didn’t look like you put the Canadian and US index funds into separate accounts…

When I login to TD Direct Investing, I have 4 accounts:

The American accounts are for if you want to purchase and hold assets with American dollars. You can puchase all of your TD e-Series funds (Canadian, US, and International) through your Canadian TFSA and RRSP.

Not quite sure why you were setup with american accounts as well, but I guess some people may prefer to deal with American cash instead of Canadian cash.

This is a little late to answer this, but maybe it will help someone else. If you own any assets that pay dividends/interests etc in USD, and you don’t want to pay the currency conversion rate, then you’d hold the assets in the USD side of the same account (i.e. your TFSA- USD vs TFSA-CAD). Or if you have CAD and you buy something that’s listed on both a Canadian and US stock exchange, you can journal it between one side or the other of your TFSA and acquire assets in the currency of your choice. For instance, ENB trades on two exchanges. If I recall, its dividends are paid only in CAD. So if you buy it on the TSX (CAD) and journal it over to the USD side, you’d pay the brokerage’s currency conversion rate. But if you buy FFH or BPY, for example, on the TSX and the journal them to the USD side of your account, the dividends – paid in USD – would accumulate in USD without currency conversion.

Hey, something I think you should note to your readers, when you set up a pre-authorized deposit of say, $200, to your TDDI account in cash from another financial institution, note that you cannot purchase any td e-series amount less than $100. So say if you wanted to split your $200 into a 30/30/30/10 split, you cannot do so since 30% of $200 is $60 which is less than the required purchase amount for any of the e-series funds. This was something I learned when I was starting out. I’ll be so glad if you know of a workaround to this!

That’s a great point. With TD Direct Investing, the minimum buy for a transaction is $100, which can make it tricky to buy funds according to your target percentages. If I am trying to add $300 to my portfolio, according to my percentages I would need to buy:

$69 – CDN

$69 – US

$69 – ITNL

$93 – Bonds

But with TD DI, I won’t be able to buy any of those amounts. Usually what I do is first look at my current re-balancing needs for my portfolio, if certain funds are lagging behind, I’ll focus on those. But overall, I’ll pick 3 to buy, a buy the minimum ($100) of those. Next month when I’m purchasing more funds, I’ll make sure to purchase from the fund that I skipped in the previous month. Your target percentages don’t have to be exact, they are just a general guide to help you determine where to put your money within your portfolio. If you re-balance once or twice a year, you’ll be able to make up for any target percentage inequalities anyways.

So if somebody was following the CCP model, I think the aggressive investing strategy is 30-30-30-10 allocation among 4 index mutual funds, then somebody who was following it strictly would need to make a minimum lump sum purchase of $300-$300-$300-$100? Otherwise they’d have to do your method of minimum $100-$100-$100-$100 then top off the the remaining 3 index funds with $200 to keep the balance in the portfolio?

Hi Trevor,

Both methods work. You can also reduce the minimum purchase amount if you setup pre-authorized purchases for the 4 index mutual funds. The minimum pre-authorized purchase amount is $25 so in theory you could set it up to be $75-$75-$75-$25.

You could then do lump sum purchases to re-balance your portfolio

Which of the TD eseries fund are good to purchase as of now? Is it advisable to buy ETF’s too?

The general idea of the couch potato e-Series portfolio is that the funds you purchase are long-term holds, and therefore the strategy of which ones to buy doesn’t change over time or depending on how the market is doing. So by that strategy, I stick to only buying the 4 funds that I originally started with (Canadian index, US index, International index, Canadian Bonds index) as they cover the global market with additional focus on domestic. There are Japanese and European e-Series index funds you could add to your portfolio as well, but that may overly diversify it.

If ETF’s are more your thing, I would suggest picking 1 route over the other (ETF’s or TD e-Series). Essentially they are different ways of doing the same thing – investing in low MER global market indexes. But I wouldn’t buy both myself.

Hello! I am a newbie in DIY investing. Just trying to be financially educated and responsible. I just recently opened a TD Direct Investing from a TD branch! The advisor I was talking to was a bit younger and also has this account which helped. He was able to open one for me no problem. I just have to wait for the online login now, so opening the account probably will take a week. At first I want to open a mutual fund and will convert it to online but he doesn’t know why anyone would do this. Now I know it’s probably because of the fees/limit. Reading from the comments, it seems like I have to buy $100 worth of index funds at a time.

The financial advisor did try to explain how purchasing ETFs have $10 fee each transaction, etc. and $25 quarterly fee (can be waived). I kept telling him I plan to purchase index funds which he seemed to not understand. I think he personally does stock/ETF buying on his own. Of course he explained the pros and cons of DIYs vs mutual fund from them (actively managed = better returns as someone watches the market and doesn’t want losses and the fee is worth it vs DIY = you have to do everything, could have consequences compared to a professional handling the investment etc).

The advisor opened a TFSA webBroker which does not have any funds this time. I currently have a regular TFSA with TD which I believe they can transfer for me to avoid messing up the contribution limit. My question is, should I open other accounts such as Canadian Cash and have funds there to be able to purchase index funds if I set-up the pre-authorized payment plan? I am trying to follow the step by step guide with screen captures which is really helpful!

I also plan to purchase RRSPs as well in the future but starting with investing in TFSA now. If I decide to do so, will I receive the contribution receipt in the mail for RRSP for tax filing? Can my mutual fund RRSP in the bank TD be transferred to the e-series? And can this be done through the branch or call the customer service from TD Direct Investing? Thank you in advance!

Congrats on getting into DIY investing. You’ve got quite a few points here, so I’ll see if I can get to all of them.

You could open a Canadian Cash account if you like, I have one as well, but I have never used it. If you are focusing on your TFSA, you can set your pre-authorzied payments to go right into your TFSA, bypassing the Canadian Cash account altogether. I think they just opened a Canadian Cash account for me by default.

Yes, you’ll get a mailed RRSP receipt for tax purposes that covers what you’ve contributed throughout the tax year.

If you have TD e-Series in a RRSP TD Mutual Fund account, you can request the bank to transfer the holding in-kind (directly) to your TD Direct Investment RRSP account, avoiding any withdrawal complications.

An in-person TD Direct Investment rep can help you fill out the paperwork to directly transfer funds. I’ve never tried doing this over the phone, but since signatures are required on forms, they may also direct you to an in-person rep.

I hope I answered all of your questions!

A few items not addressed by the earlier response:

1. ETF vs mutual fund: you’ll see that many of the e-series funds have an underlying ETF. The advantage to buying the ETF directly is that you have much lower MER. So if you plan to buy in large lump sums and hold it long term (i.e. you rebalance by BUYing more of one fund vs another, not by SELLing some of one fund to then buy another. It costs $10 each time you buy or sell an ETF.), Then sure, go with ETF. If you’re investing little bits like $100 a month, then an e-series would make more sense. You can buy and sell the e-series as many times and in any amount (subject to minimums) with no load (i.e. no commissions). The MERs are a little higher (0.33-0.5%). Also, if you want to make use of all your distributions, down the the penny, when you reinvest it or buy more, then go the e-series route as you can hold fractional units. For ETFs, TD (and most brokerages, I think) only allows you to buy and sell whole units.

Personally, I wouldn’t buy directly into the underlying ETF until I have about $10K to make one lump sum purchase, which means the buying fee is about 0.1% ($10/10K). But with the overall low fees of the e-series, there’s really no need to switch over for quite some time and certainly not if you’re planning to make frequent small transactions (buy/sell).

One final item, which is an update to the earlier response. You can now choose to receive your tax documents electronically. There’s a separate tab under their documents section for these, similarly to their statements and confirmations.

Hi there. Love the blog here mate. Have a question – do you know is it possible to do two things.

1.) make an automatic investment from ANOTHER bank each month – into the e-series? (for those of us not already at TD but who want to automate this?)

2.) is it possible to make random one-off investments in to this from another bank? just like paying a bill or something?

Thanks a bunch!

Hi Jake,

Yes on both accounts! You can setup automatic contributions to your TD Direct Investing account through another bank, but you’ll need to fill out some physical paperwork at a local TD bank to do so. And I believe that these automatic contributions would go into your specified account as Cash, so you would still have to login and buy the appropriate TD e-Series funds once the cash showed up.

And random one-off investments are my primary method of funding my investments. You’re right, it is just like paying a bill. I’ve setup a bill payment through my primary bank (Tangerine) to go as a bill to either my TFSA account, my RRSP account or my cash account within TD Direct Investing. Takes a day or 2 to go through, but works perfectly. At the end of the month, I take my extra cash and make a bill payment to my TD Direct Investing account, and when the cash shows up, I make my purchases, sticking to my target fund allocation.

actually its even easier to make payments from another financial institution into your TD brokerage account.

I set up recurring payments with Scotiabank online and searched TD Waterhouse as the payee. These payments will be be bi-weekly and I can change the frequency and amount anytime. It goes directly into my TFSA account as cash. I’m sure most major banks have an ability to set up a recurring “bill” payment for TD waterhouse/brokerage

I then requested auto-purchases of the e-series funds from my rep (I wasn’t able to find out how to do this through the TD app) so you’ll likely have to visit TD either way. I just like having control of the payments from my regular banking institution and can change them easily online so I don’t have to worry about not having enough in the account etc.

Very helpful, thank you, I just signed up for e-series last week and am looking forward to low-fee investing. Cheers

Glad I could be helpful, good luck with your investing!

Hmmm is there no way to go straight from Comfort series Mutual Funds to the e-series? How do I get the total balance of my TFSA in the Comfort series to ‘cash’ to the e-series without messing up my contribution limit?

You can use the “switch” option within TD Direct Investing. When you select the “sell” option for a mutual fund, it gives the option to “switch” instead, which skips the middle step of moving to cash. Also, even if you sell your Comfort series to cash within your TFSA, it won’t affect your contribution limit, as you have a cash fund within your TFSA. This is assuming that you’re using TD Direct Investing and not a TD Mutual Fund account within TD EasyWeb.

hi, i recently (a couple of weeks ago) moved my TFSA savings from a financial planning account to a direct investing account. i want to sell everything and invest in the couch potato model. when i tried my first sale, i got this warning: “Funds held for less than 30 days are subject to a TDW short-term redemption fee of 1% or $45, whichever is greater.” given that i just moved these over less than 30 days ago, am i subject to this fee?

What funds are your assets currently in, and what were they in before you transferred over from your financial planning account? Were they the same asset?

I had this same thing happen to me. I called TD and let them know that I was told there would be no fees, and that the branch was supposed to have moved these funds over to cash for me, so that I didn’t feel it was fair to be charged a fee to DIY something that was missed in setting up my DI account.

I was assured there would be no fee, and told to monitor the account to make sure that the fee could be reimbursed if it was to appear

Hope it gets resolved for you!

they were/are mutual funds; i had them moved over in kind.

This is probably something you would have to check in with a TD DI rep to confirm. Off the top of my head, I would guess that moving funds in-kind does not count as a new purchase, but I can’t be sure about that. If you’ve already waited 2 or 3 weeks, you may just want to wait another week or 2 to be sure that you won’t be charged a short-term redemption fee, or confirm with your bank rep. If you find out an answer, let us know what it is!

This is such an incredible resource. I love the step by step approach, it gives less risk of messing it up (the pics also help tremendously). I just purchased my first 4 funds through a TD Direct Investing TFSA account (getting my previous TD RSP Mutual Fund account transferred to e-series as well, had to fill out some forms and mail them in myself, now I play the waiting game). This info is very much appreciated. I am by no means any more than a beginner with this and I managed to do it just fine.

Always so happy to hear that my guides are making things easier for others. Thanks for the feedback!

Hi Heather,

I went in and inquired about E-Series funds the other day. I was told that they are not housed in a mutual fund account anymore – they are housed on TD Direct Investing. Was this the same thing that happened to you?

Apparently recently in the last couple of months TD E-Series moved from being able to be bought in a mutual fund account to solely being available in Direct Investing… Can anyone confirm this?

Seems like you’re the second person to indicate this. I haven’t confirmed it but maybe they’ve removed them as an option through their Mutual Fund accounts. That would be a shame.

The fact alone that there are questions about this process and articles just proves that TD is making this process not user friendly. I went in to the branch and opened a DI account to purchase E-Series funds and got no help about how to actually purchase the funds which led me to this article.

I’m not sure why everyone wants to make this so complicated and not explain it properly. I called RBC which I have my own personal investments with and the rep confused me informing me that E-Series funds bought through RBC would incur a trading cost, I explained I am confused because its a mutual fund, how is that possible. This is a easy explanation but he failed to provide it to me.

Thanks a ton!

Thanks for the info!

I just opened a td direct investing account.

They opened a TFSA, RRSP and cash account.

I’m assuming I’m supposed to max out TFSA and RRSP before buying into cash account? and In each account do the CCP model portfolios in the ratios i.e. 40/20/20/20 for each account correct?

Also, If I’m buying cash account, I know I’ll get a tax bill end of the year on any gains. How would I pay that bill? Do I cash out a mutual to pay the tax bill? I am confused because my hope was to leave it for 20 yrs to grow. In that case, if I’m withdrawing to pay taxes, then I’m not allowing it to stay put? if that makes sense?

Or are people just saving extra money in their chequings account to pay for any growth? I’m worried over time the growth can be substantial and I’ll have a hefty tax bill I can’t afford.

I would appreciate any clarification. I am a total newbie!

thanks so much!

Maxing out TFSA and RRSP are usually the best way to do things, but this is a bit dependent on what your goals for your investments. RRSP is really meant for investments for retirement, so if this is money you are thinking that you want to access before then, than a RRSP might not be your best bet.

As for the CCP ratios, again, this is dependent on your goals. Myself, I have a 31/23/23/23 split in my TFSA, but in my RRSP, I use a 0/33/33/33 as I’m investing for the very long run in that account, and will be able to wait out any major fluctuations (and of course, this ratio would change as I got closer to actual retirement).

Your tax bill on unregistered accounts will hit when you actually file your tax return with the Canadian Revenue Agency in the first few months of the next year. Filling out your tax return will measure your gains against other important financial information and calculate how much you actually owe on your investments gains. You should receive an official statement from your investment brokerage that will provide the information to fill in for your tax return.

Again, different people have different approaches to this. I don’t have unregistered investments, but I do earn extra money from some side work here and there, and I put 30% – 35% of what I earn into an untouchable savings account to be ready to pay taxes on that income. You can do the same with your unregistered investments – every time you contribute, take a small portion of the contribution and put it in a savings account that you can use to pay the tax on the gains. Estimate high, and then when it comes around to tax time, pay the tax bill out of that savings account, and invest whatever’s left over!

Are there any fees with an Electronic Funds Transfer to move money out from a TD Direct Investment account to a Tangerine Chequing Account?

It’s unfortunately not the easiest to move money out of your TD e-Series investments to another bank. I recently did this with the purchase of a new home, and it was a somewhat complicated process to move the funds out. I had to sell the funds within TD Web Broker, open a free TD savings account and transfer the cash funds from Webbroker to the new TD savings account. From there, I needed to move funds fairly quickly so I e-transferred it from the TD savings account to Tangerine in a few chunks (which incurred some e-transfer fees). I could have gotten a money order or official transfer from TD to Tangerine, but I didn’t have the time to set it all up. Whatever fees that apply with transfers from TD would then apply.

Hi there,

First of all, love your site, I’ve recently come to realize I am and have been terrible with my money, and now at almost 30 years old, I am trying to get things in order, hoping it’s not too late.

That said, it might be too late for this to be worthwhile, but unsure if it’s the case. As it stands, my only banking is done with TD, where I have my chequings, TFSA (TD every day savings account), a Credit account, and a mutual funds RSP (set up ~10 years ago, which is the one they recommended, TD Dividend Income managed by them (my MER is ~2%).

I apparently waited too long, and now will have to use TDDI to start with the e-series. I contribute $50/month to the mutual funds account (and $200 to the TFSA, though I’ve bumped that up to reach an emergency fund amount that I’m comfortable with for the time being). I could currently afford to bump that up a bit (probably a max of $100-$200/month). I don’t have the 15k across all accounts, so to avoid the TDDI fees, I would have to set up auto-deposits of $100+/month.

My question is, is it worth it to switch to the e-series on the TDDI if I’m contributing less than $400/month into it? Also, I’m not truly sure of the terminology here, but would it be smart to move my TFSA into the TDDI TFSA as well, or keep that separate? Apologies if my question is unclear, trying to catch up on everything after being ignorant for so long, but I’ll try and clarify further if necessary!

Thanks so much!

Definitely not too late. I didn’t start investing any money until I turned 31, so you’ve already got a head start on me!

I’ve heard a few mixed things lately about the availability of purchasing TD e-Series funds through a regular TD Mutual Fund account. Have you tried speaking to a TD rep to see if you can convert your regular Mutual Fund account to be able to purchase TD e-series funds? If you can do that, it would solve all of your issues as a TD Mutual Fund account doesn’t have any account minimums as far as I’m aware.

If that isn’t available anymore as an option, there are a few things you could do:

Hope that helps answer some of your questions. Good luck with your investing!

Thanks for this, going to go ahead and get a TFSA Direct Invest account opened and follow the CCP e-series guide.

I already bank with TD and have a regular TFSA with some savings in it (no investments though), does anyone know what the process would be to get my regular TFSA transferred to a TD Direct Invest TFSA? Thanks.

When I transferred my TFSA froma regular TD TFSA account into my new TD Direct Investing account, I went in person to a bank and spoke with a TD investment rep. They had a simpel form that I had to fill out and sign, and then they took care of the rest.

They also have the form online: https://www.td.com/ca/en/investing/direct-investing/why-us/getting-started/forms/ but going directly through the bank to fill out the form is probably the easiest way to do it.

Thanks a lot!

Firstly thank you for the very clear instructions. I just wanted clarification on the $100 minimum transaction. For example let’s say I open up a brand new account and want to start my investment with $100. Because there is a minimum, I would technically only be able to purchase one of the 4 funds suggested by CCP?

So for my first And subsequent purchase I would have to invest over $400 ($100 for each fund)

You’re correct, if you start with a $100 investment, you’ll only be able to purchase 1 fund. You might want to wait until you have $500 or so to start.You wouldn’t necessarily have to purchase $400 worth on subsequent purchases though. If you are put in $100 a month, for example, you can invest that $100 in whichever fund is lagging behind the most compared to your target allocations. Just continue that every month and you are essentially rebalancing your portfolio consistently throughout the year.

I may be wrong about this, but literally just on the phone with a TDDI rep and he told me the minimum applied to your entire portfolio, not per purchase. Was I given incorrect info?

Hi Liz, are you referring to the minimum amount you can purchase? For a TD e-Series fund being bought through TD Direct Investing, the minimum transaction size is $100. If you are talking about account minimums that avoid account fees, then you are right, it applies across the portfolio.

Hi. Thank you for such an insightful article. This really helped me alot in furthering my knowledge and comfort of Direct Investing.

I am hoping you would be able to help me clarify a few things:

I am planning to transfer my daughters RESP from another institution to TD Direct Investing. I still need to contact TD to set it up, but however I have been researching on what steps to take and what not. So my question is, is it better to transfer the fund in-kind or cash? Once the fund is moved, I plan to convert that into index fund.

I have also been looking into TD index e-series and most of those it states that “it is eligible for RRSP” but it no where states that it is eligible for RESP or TFSA. Can I still buy those tdb900/902/911/909 to create a balanced RESP portfolio?

Glad you found the article helpful. If you are planning to eventually buy index funds, then transferring in cash is likely better for you, as you’ll have to just sell them yourself after the transfer if you transfer in-kind. There shouldn’t be any tax implications, but you should double check with your current financial institution to see if they have any additional fees for making the transfer.

TD e-Series are RESP elligible. You can see a sample RESP portfolio that another Canadian finance blogger has that consists of TD e-Series funds.

Hi, your article and replies to various queries are really helpful in understanding some of the queries I had. I am in the same boat as HC as I want to move my family RESP account to TDDI solely to invest into td e series index funds following CCP. Someone suggested me to speak to TD rep to get cost of RESP transfer covered (whatever my existing financial institution charges). I am confused if a direct switch is possible or I need to sell my current mf holding and reinvest them in e-series.

So if you have investments with another bank, and are switching them to TDDI, then it is good to talk to a TDDI rep as most institutions with charge you to move registered investments to another institution. TDDI should offer to cover those fees for you as they will want your business. Whatever you have your funds in, with the right paperwork, you should be able to directly transfer them to TDDI (if it’s a fund that TDDI buys/sells). At that point you can switch them to TD e-series funds. Depending on what you currently have, TDDI may charge you a transaction fee to sell the funds you currently have.

Hi.

I want to be able to set up MONTHLY PAP of various TD E Series but there does NOT appear to be any way to self manage this. Only way I am told is to call TD and have them set it up for you but they wont let the customer manage it online. This seems odd given its 2020!

any thoughts. is this correct?

Are you wanting to contribute from a TD account? Another way that you could do it is setup a monthly automatic bill payment, that would send money to your TD Direct Investing account, at which point you could go in and manually manage and make your TD e-Series trades (but the trades wouldn’t be automatic). Unfortunately, TD Direct Investing isn’t as advanced as some of the other discount brokerages, and doesn’t quite give you the options and control to make things easier.

Hi there – not sure if you have any insight, but I was in TD the other day for 2 hours to add an eseries RESP mutual fund account for my second child (I already have one for my first child, plus a TFSA account for myself). When I first set up my TFSA 10 years ago, no one in the branch knew what I was talking about. 5 years ago, the advisor was very knowledgeable about the eseries accounts and the RESP was set up very easily. Yesterday, it was like 10 years ago, lol. I now have a second RESP account under the same family plan, but it’s not an eseries account (I have a Comfort Growth Portfolio); she told me I could add the eseries funds after, but they are not available to me for this account. I noticed the eseries conversion form I used to use is no longer online on the web site (the link doesn’t work anymore). Am I still able to set my account up this way as a mutual fund account first? Ideally I’d like to keep it the same as my other accounts because it’s what I’m familiar with, but not sure if things have changed and I need to go another route. Thanks for any insight.

It’s unfortunate the the help that you get really depends on the person that you get from TD and their own knowledge level. It’s been a while since I’ve invested in TD e-Series funds through a mutual fund account with TD, and I’ve heard mixed messages lately on the ability to convert TD Mutual Fund accounts to be able to buy e-Series funds. Where you might have better luck is through the phone, and talking to an investment rep who may have more knowledge then the person just trying to sell you TD mutual funds with higher MERs. And depending on how much you have invested, you may want to just look at converting to a TD Direct Investing account, and moving all of your registered funds there.